Day-to-day operation of mortgage industry is a complex process and is highly dependent on paper documents. Since regulations and compliance rules are clearly stated in mortgage industry, each document and data stored in these documents need to be processed accurately. Manual processing of mortgage documents is very time consuming and also prone to error.

Lenders receive several forms and documents in various formats to be processed for a standard mortgage application.

- Income verification or employment

- Assets and debts

- Credit history

- Identity

- Rental history

- Others

That’s why mortgage automation promises great benefits and opportunities for lenders and borrowers.

How to Automate Mortgage Document Processing?

Data extraction from above mentioned documents is the core of mortgage automation. Intelligent document processing (IDP) solutions like onVision, use cognitive data capture technologies to extract data with high accuracy. Machine learning (ML) adds another dimension and eliminates fraud, duplication or trivial human errors.

This doesn’t mean loan officers will no longer be involved in the process. Their role will switch from repetitive tasks to strategic and critical ones.

With the help of ML, mortgage application cycle becomes faster and more secure. Lenders, financial constitutions, banks, insurance companies and also borrowers benefit from intelligent automation solutions.

Benefits of Mortgage Automation

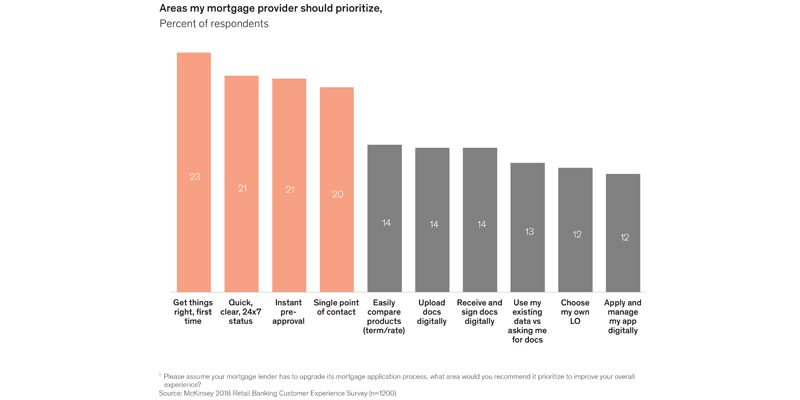

According to a McKinsey report, customer satisfaction is real differentiator in mortgage industry. Considering that mortgage industry is highly competitive, it is obvious that companies who invest in automation will stand out among competitors.

Another clear benefit of automating mortgage document processing is reducing operational costs up to 80%. Becoming more productive and profitable is possible via automation.

Regulatory compliance is another critical issue for mortgage lenders. Companies have to meet strict guidelines, otherwise they may face with legal penalties or even revocation of authorization. Mortgage automation helps lenders to track each step easily and getting ready for audits.