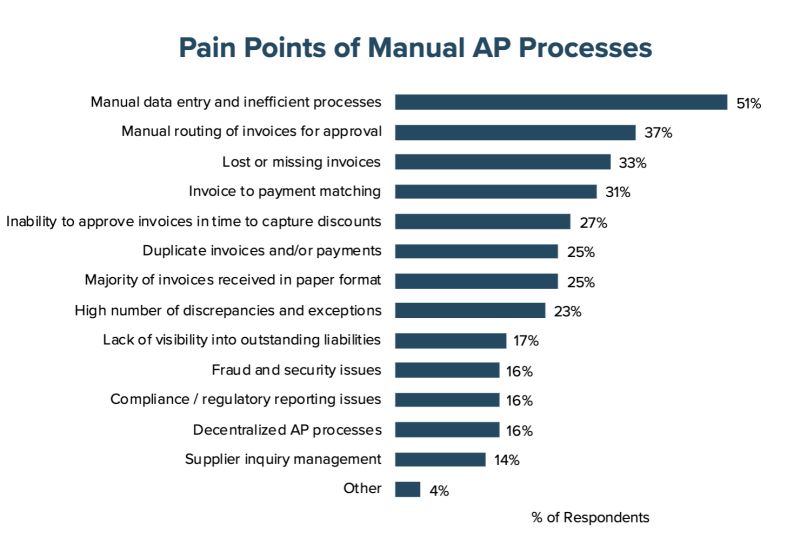

Although efficiency of Accounts Payable (AP) department is a key factor for an organization’s financial and operational success, many companies – regardless of their size – still struggle to streamline AP processes. It is more surprising that even companies which use ERP or accounting software are experiencing hard times with manual invoice processing.

As you can see above, according to the results of a 2020 dated research; half of the respondents complain about manual data entry. Approval stage of invoice processing follows as the second biggest issue and the list goes on. Data from another research says almost the same thing, 55% of companies process financial data manually.

Is It Easy to Adopt Accounts Payable Automation?

In an ideal world, yes. However, change doesn’t come effortlessly. No matter how sophisticated technologies we have, or how big amounts we pay. We have to face several barriers when we attempt to deploy accounts payable automation within a company. Legacy business models, long implementation times, ROI concerns, lack of support or resistance to change can be listed among most frequently seen barriers. Best way to overcome all of these issues is to unveil the benefits of AP automation.

What are the Benefits of AP Automation?

- Fast & Feasible: Manuel processing of an invoice takes days and routing for approval causes unavoidable delays and errors. AP automation accelerates whole invoicing cycle and generates concrete ROI. Early payment discounts and elimination of possible late payment penalties are obvious financial benefits.

- Increased accuracy: When a company transforms its AP workflow into a fully automated AP process, errors inherit to manual work disappear. AP automation software, which is enhanced by AI capabilities can easily read invoices and extract data accurately.

- Fraud Protection: According to AFP survey, 81% of companies faced payment frauds in 2019. You can easily design a secure and automated approval workflow with AP automation software. Increased transparency of spend management will be a powerful shield against fraud and duplication.

- Audit readiness & compliance: Comprehensive AP automation solutions match every invoice with PO numbers and receipts automatically. This feature is beneficial for auditing and also for compliance. AP department is always able to reach and search data easily.

- End-to-end integration: A well designed AP automation solution includes connectors for ERP systems and can be integrated to any accounting software. Hence, your core business systems will function more effectively.

- Better vendor management: It is crucial for a company to find and preserve best vendors. Companies using AP automation tools improves operational harmony with their vendors. And days payable outstanding (DPO) is reduced by 18% through automation.