Why is form extraction so important? Let’s try to make a list of paper form types, which contain valuable data for organizations.

- Account opening forms (Banking, Insurance)

- Customer satisfaction forms (Retail, HORECA, Services)

- Job application forms (All industries)

- Proof of delivery forms (Transportation, Courier)

- Medical record forms (Health, Medicine)

- Complaint forms (Public sector, Aviation)

- Registration forms (Education, Travel)

- Surveys (All industries)

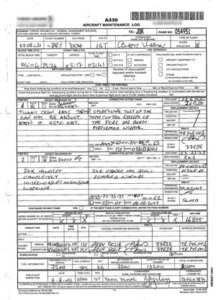

- Maintenance Forms (Logistics, Aviation, Automotive)

These are only a few examples of most frequently used form types. The list goes on.

Now, think that almost all of these forms are filled handwritten and you need to read, understand and classify every data. You can imagine how big amount of time it takes to complete the task manually. Moreover, you need to process data properly to make it ready for use. You can use a data entry layout or tool to speed up processing, nevertheless you would have to prepare a new layout and workflow for each new form type. Even for a single input field added to the existing forms.

AI Makes It Possible to Automate Form Extraction

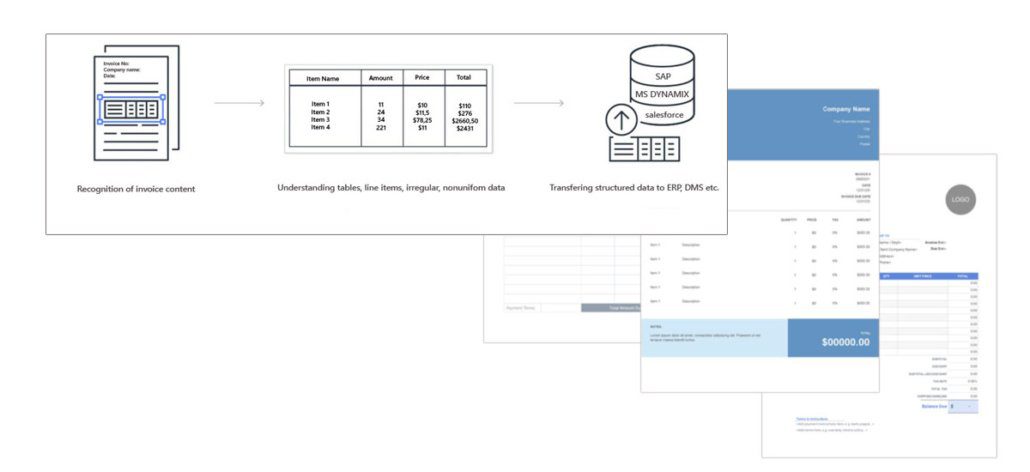

We are lucky that there is a cost-efficient solution for this intimidating business problem. Automated form extraction (also called; form capture or form ICR) is combining ICR (intelligent character recognition) technology with AI and thereby extract any type of data easily from handwritten forms.

We are lucky that there is a cost-efficient solution for this intimidating business problem. Automated form extraction (also called; form capture or form ICR) is combining ICR (intelligent character recognition) technology with AI and thereby extract any type of data easily from handwritten forms.

ICR is the muscle of automated form processing while AI is the brain. Without utilizing AI, extracting handwritten content would be less useful. Since you need to interpret, validate, classify and integrate extracted data, AI plays an essential role in automation of form processing. Another asset of AI is the capability of processing new form layouts, which are not recognized by the system previously. This feature reduces need for human intervention and minimizes errors.

How Does Form Automation Work?

onVision Intelligent Form Capture is a cloud-based solution and it can be used through API or by Web scan. After you scan the form or take a photo of it by your mobile device, you can upload it to the platform. We can also listen an e-mail inbox or watch a folder to collect forms. Once the document reaches to the platform, handwritten data is extracted in seconds and structured output is generated in XML or JSON format.

From there on it becomes possible to use data as you wish, according to business rules and workflows. You can also employ RPA solutions to optimize any process. Thus, your organization will not only save time and money, but also improve its way of doing business and customer/employer satisfaction.