Automated invoice processing is extracting data from incoming invoices and transferring it to any ERP or financial system within seconds. To achieve this task, companies need a well-designed framework which works seamlessly.

Processing invoices and payments is a complex and a very time-consuming process with hundreds and thousands of invoices arriving in various formats (e-mail attachments, PDFs, paper based etc.). If accounts payable team is working manually to process invoices, errors and delays occur unavoidably. For this reason, using an invoice automation software creates great benefits for companies.

How to Automate Invoice Processing?

Invoice processing as a business function, may seem relatively simple job with a low priority. It is not the case though. First of all, invoice processing has a multi-channel workflow and it sits in the middle of three critical processes: operations, production and finance. How can a company manage its supplier chain without running a fast, productive and error-free accounts payable operation? How is it possible to keep production lines (or services) working without managing your supply chain properly?

With its important role, invoice processing workflow needs to be improved. To do this, invoice automation solutions have been developed for the last decade. Let’s dive in details and see how to automate invoice processing.

Invoice Automation Basics

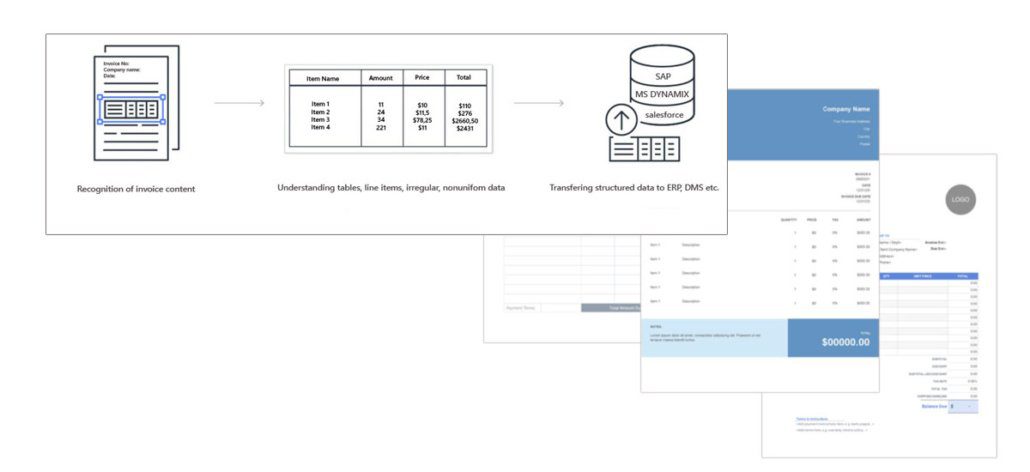

There are four main steps of invoice automaton.

- Digitizing physical invoices (scanning)

- Extracting data from invoices (invoice OCR). Powerful OCR and ICR engines let us to extract data from files in various formats such as PDF, jpg, TIFF.

- Interpreting and analyzing the invoice content. AI and machine learning technologies come to help at this stage. Pre-trained invoice automation solutions are able to understand unstructured or nonuniform contents and classify them. No human intervention is needed.

- Integration to core systems such as SAP, MS Dynamics, Oracle etc. (connectors and APIs)

An intelligent invoice automation software can handle these four steps seamlessly and help your company to save time, money and valuable other resources.

Invoice OCR or Cognitive Data Capture?

OCR (optical character recognition) is the technology which makes automated invoice processing possible. When you scan a physical invoice or take a photo of it, OCR turns optical characters into digital data. ICR (intelligent character recognition) is the advanced version of OCR. It can even turn handwritten texts into digitally usable data.

However, invoice OCR does not suffice to fully automate invoice processing. It is mainly because, OCR software without an AI component can only extract data from pre-defined templates. When you add a new vendor to system, rule based OCR software is incapable of extracting data from new invoice layout since it doesn’t know how to process fields, line items, shapes etc.

Cognitive data capture, on the contrary, uses artificial intelligence to read invoices. Two key features of cognitive data capture are; ability of AI to learn by itself and ability to understand patterns and layouts which are not seen by it before.

Thanks to these two key features, cognitive data capture doesn’t require human supervision or continuous controlling. So that it really automates invoice processing and saves huge volumes of manpower. You can learn details about onVision Invoice Extraction solution here.